Checking What Filings Are on Included on Your Tax Statement

It's easy to see and download the policies and endorsements that make up the amounts on your tax statement.

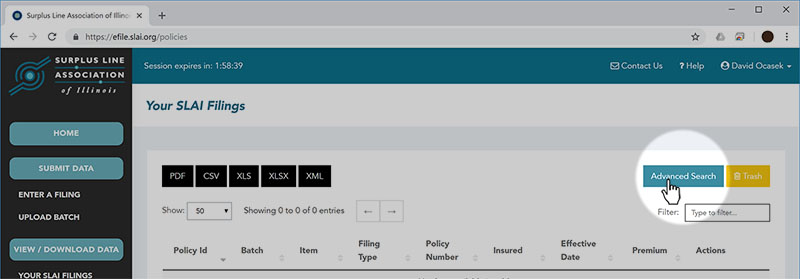

- Log into the EFS

- Click on "Your SLAI Filings"

- Click on "Advanced Search" (blue button, near the top-right corner of the page)

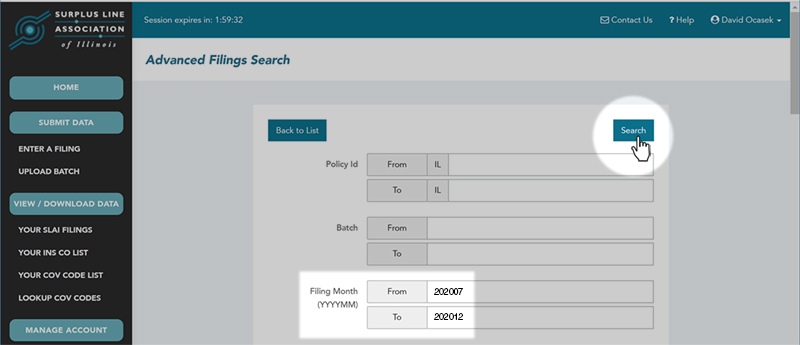

The third item in the search form is the "Filing Month".

Filing Month is not the same as calendar month

because we usually cut off the month early in June and December in order to prepare and mail

your tax forms in a timely manner. You could file something on June 29th that is in the July

"Filing Month".

- In the "From" box, put the first month of the tax period as the criteria, using the YYYYMM format. For instance, if you were checking the 2nd half (July-December) of 2020 Surplus Line Tax Statement, you would use 202007 as the first month of the period.

- In the "To" box, put the last month of the tax period as the criteria, using the YYYYMM format.

Following the same 2nd half of 2020 (July-December) example, you would use 202012.

- If you are matching up to a fire marshal tax statement, you will need all twelve filing

months. So for the 2020 fire marshal tax statement, the first month would be 202001 and the

last month would be 202012.

- Click the "Search" button.

Example:

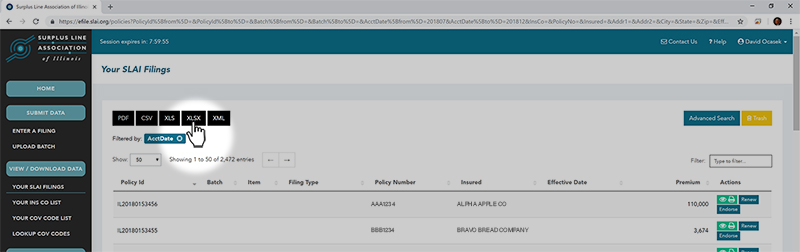

Downloading Your Search Results

By default, the system only shows you 50 records at a time, and only shows eight data

fields for each record. Don't worry - when you download your data, you will get all

the data elements for each record, and you will get all the records that match your

search criteria.

The easiest way to see, search and manipulate your data is download it to an Excel file.

- Near the top-left corner of the screen, click the "xls" or the "xlsx" button (depending on your

version of Excel)

- Save the file to your computer

Now, you can sort, search and manipulate your data in Excel. You may have to convert the number columns from "numbers entered as text" to actual numbers (instructions on how to convert can be found here. Total up the premiums and taxes

to see that they match our tax statement. You can add subtotals by Filing Month to match up to

each month on your surplus line tax statement, if desired.

DON'T CHANGE THE NUMBERS ON YOUR TAX FORM!!

By law, taxes are due based on what you filed with the Association - not based on effective

dates or any other criteria. DO NOT change the numbers on your tax form. If you feel something

needs to be changed, it MUST be coordinated through the Association.

Contact us and we will figure it out.

We're Here to Help

Feel free to contact our office with any

questions you have about your tax statements, or for help with this process of matching

up your tax statement to the policies that were filed. We're happy to help!

|